- Operator Name: Chainbase Staking

- Website: https://staking.chainbase.com/

- Operator Profile: Institutional Staker

- Experience: Chainbase Staking is at the heart of validator infrastructure, supporting services across over 20 public blockchain networks and protocols. We manage assets worth over $250 million with the commitment that goes beyond top-tier Service Level Agreements. We work hand in hand with ecosystems to enhance on-chain activities and contribute greatly to network governance and security. Think of us not just as your validator, but as a dedicated partner in building a stronger, more vibrant ecosystem together.

- Team: Chainbase is powered by a team of 30 engineers and research scientists across the globe. Our team comprises a mix of backend and frontend developers, data scientists, data architects, blockchain specialists, and project managers.

- Mainnet restake amount: If you currently natively restake on the mainnet.

- Where do you run your infra: Singapore, Hongkong and Europe

- What rate do you plan to set your operator commission rate: Based on the ecosystem, we range our rate between 5% to 10 %.

- Performance Metrics: To ensure our network’s security and reliability, we implemented multiple solutions for remote signer. Our track record demonstrates a consistent uptime exceeding 99.98% across all chains we support.

- EigenDA Testnet Performance:

We have been early adopters of EigenDA’s operation, maintaining stable(99.99%+) node operations since the beginning.

https://goerli.eigenlayer.xyz/operator/0xfe6ad5bd4083044102d9438ad99af8d290230f8d - Plans to opt-into additional AVSs:

-

Are you running any AVS testnets other than EigenDA? No

-

Are there any AVSs you plan to opt-in to? Yes. We are currently looking into Decentralized Sequencers, Privacy-Enhanced Oracles and Specialized Data Storage Layers.

-

How do you plan to evaluate AVSs?

- Audit and Code Review: The most critical aspect is the security of the AVS, which can be gauged through comprehensive audits and public code reviews.

- Slashing History: Review the history of slashing incidents.

- Unintended Slashing Mitigation: Review the measures in place to prevent unintended slashing,

- Node Performance: Consider the performance benchmarks of nodes within the AVS.

- Reward Structure: Understand how rewards are distributed among stakers and validators.

- Use Cases and Applications: Evaluate the range of applications and use cases the AVS supports, and its potential to enable new functionalities within the Ethereum ecosystem.

-

Are there any types of AVSs you would not opt into? We welcome any AVS that meets our criteria.

We are cautious about some specialized or niche AVS in the Ethereum ecosystem that might focus on very particular functionalities rather than a broad range of applications. Some Low-Latency Networking Layers might rely on more centralized infrastructures or some Identity Verifiers that might attract regulatory scrutiny, especially concerning privacy laws like GDPR are the ones we are cautious about.

-

- Operator Name: Universe Node

- Operator address: 0x34287944835F89721853b51BFfa328F3d22Bc3bC

- Website: https://www.universe.com

- Operator Profile: Institutional Staker

- Experience: 5+ years blockchain experience, 4+running nodes

- Team: We are a team of crypto enthusiasts started participating in blockchain activity from early 2015.

- Mainnet restake amount: 64

- Where do you run your infra: japan

- What rate do you plan to set your operator commission rate: 2-5%

- Performance Metrics: 99%+ average attestation effectiveness.

- **EigenDA Testnet Performance:**The software worked as expected and without errors, only interrupted by a software update and got kicked out because of lack of restaked gETH.

- Plans to opt-into additional AVSs:

- Are you running any AVS testnets other than EigenDA? yes of course,i run mangata avs

- Are there any AVSs you plan to opt-in to? omni/espresso/mangata/metaeth

- How do you plan to evaluate AVSs? Costs, rewards, team, product, security and many other factors.

- Are there any types of AVSs you would not opt into? no sure now

- Operator Name: Wagmi Ventures

- Website: https://wagmiventures.co.uk

- Operator Profile: Solo-Staker.

- Experience: This is not official Wagmi ventures - I didn’t know there’s one existing when I started the operator. I’m ETH genesis buyer, early ETH node runner and have experience with running many L1s nodes.

- Team: I’m alone but I have automated monitoring.

- Mainnet restake amount: 32 ETH.

- Where do you run your infra: EU

- What rate do you plan to set your operator commission rate: 3%

- Performance Metrics: The node was running until around 2 weeks before the end bcs I had to change HW because of overheating, otherwise I had +99% uptime when I was in the top 200.

- EigenDA Testnet Performance: My operator was updated as soon as possible, did well thanks to the great docs from the EigenLayer team.

- Plans to opt-into additional AVSs:

- Are you running any AVS testnets other than EigenDA? Mangata

- Are there any AVSs you plan to opt-in to? omni and espresso

- How do you plan to evaluate AVSs? Team, product, security, funding, quality overall.

- Are there any types of AVSs you would not opt into? I plan to opt-into other AVSs.

-

Operator Name: Validation Cloud

-

Operator Profile: Institutional Staker

-

Experience:

Validation Cloud is a SOC 2-compliant enterprise-grade Web3 infrastructure company. We adhere to a suite of comprehensive and targeted controls that address everything from monitoring, personnel operational security, disaster response procedures, encryption, risk assessments, vulnerability scanning, and infrastructure remediation to assure 99.99% uptime.

-

Team:

Validation Cloud has been operating infrastructure since the earliest days of Proof of Stake in 2018. We were some of the earliest partners of ecosystems like Polygon, Chainlink, and Flow. More recently we have become one of the largest validators on Aptos & dYdX and are supporting promising ecosystems such as Aleo, Berachain, and Saga.

-

Where do you run your infra:

- Globally (predominantly Switzerland, US, & Singapore)

-

What rate do you plan to set your operator commission rate:

- 5%

-

Performance Metrics:

Validation Cloud has ranked as the #1 node operator in the world by CompareNodes for almost 12 straight months. Our global devops team has strict monitoring, alerting, and operational systems set up to ensure 99.99% uptime.

-

EigenDA Testnet Performance:

Validation Cloud was one of the first 30 operators invited to join the EigenDA testnet. We have been part of the active testnet set since Day 1, which is nearly 6 months straight of operation. Validation Cloud has also consistently been in the top 10 as one of the largest operators on the EigenDA testnet.

Our internal performance metrics showed we had a +99.99% uptime and <1 hour response time for updates.

-

Plans to opt-into additional AVSs:

- We plan to opt-into as many high-performing AVSs as possible. Accordingly, we have developed an internal scoring system to rank AVS’s based off of parameters including risk management, technical requirements, and ecosystem strength.

We are currently supporting 5-6 AVSs on private testnets right now and plan to selectively add more. We will publicly disclose which ones as they get announced, but feel free to contact our team to learn more!

- We plan to opt-into as many high-performing AVSs as possible. Accordingly, we have developed an internal scoring system to rank AVS’s based off of parameters including risk management, technical requirements, and ecosystem strength.

contact: [email protected]

- Operator Name: BLOCKDAEMON

- Website: https://www.blockdaemon.com/eigenlayer

- Operator Profile:

- Leading blockchain infrastructure provider servicing over 400 enterprise customers, demonstrating the security, reliability, and scalability of our services.

- As an ISO27001 certified, institutional-grade, provider we currently secure well over $100Bn of digital assets via our staking platform and our MPC-based self-custodial solutions.

- Our products range from full nodes, archival nodes, data APIs, institutional staking services, and MPC-based self-custodial solutions.

- Experience: Since 2017, our 200+ team members have launched and managed over 150,000 nodes across 40+ leading blockchain protocols. We have been a genesis partner to over 25 new blockchains, and are managing tens of thousands of ETH validators for some of the largest ETH holders.

- Contact the team for more information: Email, LinkedIn, Twitter

* - Team: 200+ team across North America, Europe and APAC with 24/7 customer support spread across the globe

- Mainnet restake amount: Restaking fully accessible in our staking flow

- Where do you run your infra: 70+ points of presence in the cloud and on bare metal servers across the world in Tier 3 data centers using clean energy

- What rate do you plan to set your operator commission rate: highly competitive rates and discounts available if you also use other Blockdaemon products

- Performance Metrics: General uptime 99.9% + failover for every validator to minimize vendor and geo risk

- EigenDA Testnet Performance: Several weeks in active set with very solid performance and great testnet success overall

Plans to opt-into additional AVSs:

Currently engaged in a number of AVS testnets and partnerships, and will support several AVSs at launch - follow us on X for our latest announcements. ![]()

Our risk-reward-based approach to AVS selection follows in-depth reviews of the maturity of the tech and team as well as compliance considerations. ![]()

We’ll also listen to customer demand, e.g. from our LRT partners.

If you want to join our rapidly growing network of ecosystem partners as an AVS, LRT, restaking service provider etc, please do get in touch! ![]()

Operator Name: Node Rookie

Operator Profile: Solo-Staker

Experience: With over 2 years of experience, we have been running validator nodes for more than 5 networks, including IronFish, Sui, and Aptos.

Team: A team of blockchain power users and experienced validators.

Mainnet restake amount: 10+

Where do you run your infra: EU, US

What rate do you plan to set your operator commission rate: 3%

Performance Metrics: We were able to provide smooth services with >99% uptime.

EigenDA Testnet Performance:

Running the EigenDA testnet has provided us with valuable insights and practical knowledge in operating within this experimental environment. We were in the active set from the first days of running our node until the last day of Goerli testnet and it lasted 30 days. We could achieve uptime of >99% during this period.

The steps in running node were straightforward, and the instructions were very comprehensive.

https://goerli.eigenlayer.xyz/operator/0x5E4E39D24059C6cd15b6AE8612214d75c8aa95bC

Plans to opt-into additional AVSs:

Are there any AVSs you plan to opt-in to? Yes, We can name Altlayer, Omni Network, Espresso

How do you plan to evaluate AVSs? We evaluate their economic sustainability, market demand, revenue potential, cost-effectiveness, regulatory compliance, and long-term viability within the business landscape.

Operator Name: Kashing Investments – Infra Division

Website: https://kashing.fund/

Operator Profile: Institutional Staker

Experience: We are a web3 investment fund management company that’s has recently entered the staking realm. We’ve assembled a strong team of SRE engineers with decades of experience running highly resilient, redundant, and available enterprise grade platforms

Team: Our team has over 50+ years of collective experience running enterprise grade infrastructure

Mainnet restake amount: 32 ETH

Where do you run your infra: EU, NA, APAC

What rate do you plan to set your operator commission rate: 1.75% intro rate

Performance Metrics: 99.99% uptime

EigenDA Testnet Performance: several months in the top 200 AVS validator set with 99.99% (or better) up time

Plans to opt-into additional AVSs: We are evaluating other AVS opportunities and will most certainly participate in many of them.

Operator Name:未来A8

Website:https://twitter.com/node_shaoshao

Operator Profile: Solo-Staker.

Experience: I have been involved in testing since 2017 and have operated nodes of many encryption projects, such as mina, hopr, marlin, galagames, graphprotocol, and other project nodes.

Team: We are a group of OGs who have been participating in various crypto projects in the crypto industry since 2016

Mainnet restake amount: 100E

Where do you run your infra: Tokyou

What rate do you plan to set your operator commission rate: 5%-10%

Performance Metrics: I have maintained 100% online since registration on January 27. After I fell out of the active node due to the amount of pledged eth, I found and replenished the pledged eth in the shortest possible time to make the node active again.

EigenDA Testnet Performance:After joining the mainnet on January 27, the upgrade was stopped for several hours, and then after a quick update, no technical problems were encountered until the recent goerli testnet crash.

How long were you in the active set? since January 27

What were your performance metrics? 100% online

Are you running any AVS testnets other than EigenDA? mangata

Operator Name: Plankton

Operator Profile: Solo-Staker

Testnet Node:0x20caf6c60411b2e4ef27a1b4f829d641ba41984e

Experience: During two years I launched many different projects of which only 4 remain on a permanent basis

Team: Our small team has extensive experience in the field of corporate infrastructures

Mainnet restake amount: 15+ eth

Where do you run your infra: Europe

What rate do you plan to set your operator commission rate: 2 %

Performance Metrics: uptime - 99.9%

EigenDA Testnet Performance: More than a month in the top 200

Plans to opt-into additional AVSs:

*Are you running any AVS testnets other than EigenDA? :*NO

Are there any AVSs you plan to opt-in to? BABYLON , Aethir , XAI

How do you plan to evaluate AVSs? : Good reliability

Are there any types of AVSs you would not opt into? : NO

Operator Name:MorningStar20th

Website:https://twitter.com/tuzhu2046

Operator Profile: Solo-Staker.

Experience: 3 years of experience in encryption project node testing and mainnet node operation

Team: A few OGs who believe in crypto

Mainnet restake amount: 30E

Where do you run your infra: EU, US,Asian

What rate do you plan to set your operator commission rate: 2%5%

Performance Metrics: 98% online since registration on January 30

EigenDA Testnet Performance:I have been online since registering on January 30, with no technical problems and completed two updates.

How long were you in the active set? January 30- March

What were your performance metrics? 98% online

Operator Name:ahope

Website:https://twitter.com/i2yeah

Operator Profile: Solo-Staker.

Experience: 2 years of experience running crypto project nodes

Team: A mainnet node operation group composed of several friends

Mainnet restake amount: 50E

Where do you run your infra: EU, US

What rate do you plan to set your operator commission rate: 3%-6%

Performance Metrics: 99% uptime since January 30th

EigenDA Testnet Performance:While the node is active, it is updated twice. There are no other technical issues

How long were you in the active set? since January 30

What were your performance metrics? 99.9% uptime

-

Operator Name: BlockPI Network

-

Website: https://blockpi.io/

-

Operator Profile: Backed by well-known investors, BlockPI Network is a decentralized infrastructure provider, offering RPC services across 40 networks and processing over 50B requests every month. By supporting ERC-4337 as a pioneer in this industry, BlockPI is not only the only one providing the most diversified Bundler services in the market currently, but also supported by Ethereum Foundation in building Account Abstraction Explorer for the community. We also developed two open sourced developer tools. One is an UserOperation Indexer for ERC4337 Account Abstraction(https://github.com/BlockPILabs/erc4337_user_operation_indexer ). It will improve the efficiency of querying UserOperations thousands of times. The other one is an RPC aggregator, RPCHub(https://rpchub.io/), which allows developers and project to integrate different RPC endpoint in the aggregator and utilize different providers in one endpoint at the same time.

-

Experience: In addition, we have been running our validating business since 2017, used to under the name Nodeasy. Over the last 6 years, our validating business is famous for its guaranteed the stablest node operation, the best SLA, active ecosystem engagement (including but not limited to governance voting, security maintenance, bug report, etc). Currently, BlockPI is validator on Cosmos, Cardano, Near, Polkadot, Avax, Oasis, Mina, Agoric, MAP Protocol, Certik, SSV, Kusama, Stafi, Kava, Forta, Irisnet, IoTeX, Obol, Platon, Axelar and etc.

-

Team: We have 20 employees across Asia and North America, provide 24/7 customer support.

-

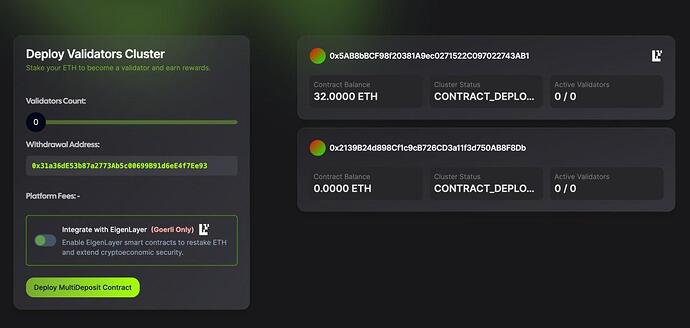

Mainnet restake amount: 64ETH

Validator 1095724

Validator 1122381 -

Where do you run your infra: we have various cloud service provider/baremetal all over the world. We’re running hundreds servers in EU/APAC/NA region.

-

What rate do you plan to set your operator commission rate: 3%

-

Performance Metrics: Our validator service have more than 6 years experience. served 30+ network and maintained 99.99% SLA.

-

EigenDA Testnet Performance:

- Describe your experience running the EigenDA testnet.

We started running the EigenDA testnet in November 2023, and we have been a part of the active set ever since. - How long were you in the active set?

4 months - What were your performance metrics?

Here’s our operator: https://goerli.eigenlayer.xyz/operator/0x2d5CAa72D61cC4e7a61F71CBFf30ec625F67ad4d

The performance score is 100 and uptime is over 99%

- Describe your experience running the EigenDA testnet.

-

Plans to opt-into additional AVSs:

- Are you running any AVS testnets other than EigenDA?

Only EigenDA - Are there any AVSs you plan to opt-in to?

Omni Network, Altlayer, Lagrange, Witness. - How do you plan to evaluate AVSs?

We evaluate AVSs based on their ability to effectively utilize EigenLayer security. - Are there any types of AVSs you would not opt into?

It depends on the quantity of each AVS.

- Are you running any AVS testnets other than EigenDA?

- Operator Name: A41

- Website: a41.io

- Operator Profile: Institutional Staker

- Experience: A41 started as a validator since mid-2022 and currently hold $2.2B+ TVL. We support 20+ chains such as Ethereum, Aptos, Polygon, Sui, NEAR, Solana and etc. As one of the fastest-growing validators last year, A41 has participated in most of the existing LSPs such as Lido and mETH as an operator. As a trusted infrastructure provider with a proven track record of excellence, we offer optimal performance and security. Moreover, we can provide unique value proposition for being in the KR region. For instance, A41 is the sole bare metal operator for Lido in the region. Due to our geographical uniqueness, our team has extensive experiences in detecting and resolving latency issues under stress conditions to achieve geographical diversity across various chains as well.

- Team: Our core team members have various experiences - serial entreprenuer, start-ups, corporates from verticals such as game, electronics, retail, IT, mobile and etc. We transitioned our career into Web3 with a mission to bring crypto-economy to real life. Our team’s strength is that we have a good mix of crypto native and non-crypto native, we believe this well-mixed chateristics enable us to provide serivce with a good understanding of blockchain + crypto, but also professionally with a customer-centric mind.

- Mainnet restake amount: 100

- Where do you run your infra: Asia, specifically Seoul, Korea

- What rate do you plan to set your operator commission rate: 5%

- Performance Metrics: 99.9% uptime, no slashing

- EigenDA Testnet Performance:

- Describe your experience running the EigenDA testnet.

- Participated in the testnet from the beginning and operated natively staked 16,000 ETH with 500 validators and also delegated LST from various delegators. Also leveraged monitoring/alert system to monitor 24/7.

- How long were you in the active set?

- About 3 months

- What were your performance metrics?

- 99.9% uptime, no slashing https://goerli.eigenlayer.xyz/operator/0x73bf91bb1327415ec7b9d436bfced67c3ee843fa

- Plans to opt-into additional AVSs: Based on our regional strengths and extensive experience in operating various chains, we plan to onboard multiple AVSs as a trusted infrastructure provider.

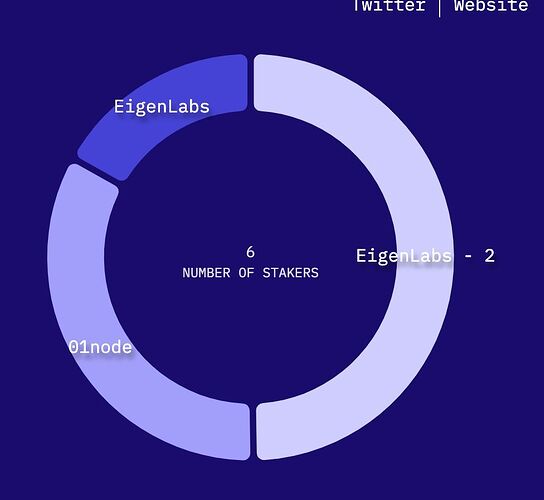

Operator name: 01node

Website: www.01node.com & https://linktr.ee/01node

Operator profile: Institutional staker

Experience: With over $350m aum over 40 networks and with the gained trust of over 50,000 users, 01node is a high-quality staking and validation service provider, based in Romania. Our teams’ combined expertise allows us to run a variety of services, not the least of which regards validator-as-a-service, RPC node and application operations, on our time-tested, fully owned and operated infrastructure, from Bare metal servers.

This is well reflected in our reliability track record as we prioritise security and best practices for each layer of our infrastructure. Supported by our sophisticated technical infrastructure, 24/7 customer support, Tier 3 hosted redundant infrastructure and our highly skilled team of professionals we aim to provide the best performance and reliability across our provided services range.

We tested eigenlayer on DVT setups on both obol and ssv with success [restaking works on DVT setups], we have an inhouse built staking pool for both of them with staking integrated, available on demand and soon open to the public.

Operators on mainnet for other protocols like stride, obol, ssv, gnosis, lido, etc. Participated in multiple testnets run by Lido, on both obol and ssv clusters, we were one of the first to test eigenLayer integration.

Team: Our team is currently comprised of over 12 people with their expertise spanning from devops, full stack software development, network design and architecture and information security with their experience adding up to decades.

Mainnet restake amount: 500 eth from treasury + another 500 from our delegators as initial funds, we expect to deploy more capital as soon as we bring our solution to the market.

Where do you run your infrastructure: We run our fully redundant infrastructure in two Tier 3 datacenters based in Bucharest, Romania, both equipped with N+1 redundancies for both cooling and power supply. Our infrastructure consists of fully owned bare metal servers backed up by Cisco networking equipment.

What rate we plan to set our operator commission rate: 5%

Performance Matrics: 98% average attestation effectiveness.

EigenDA Testnet Performance: We have enterprise staking solution with eigenlayer bridge. ES-Staking & SSV DVT System: Enterprise staking architecture by making use of Obol and Ssv Distributed Validator Technology (DVT) for Ethereum staking, underlining the cutting-edge nature of your services.

Our proposed solution offers all of the advantages of ease of use and transparency of an easy to comprehend user oriented frontend interface that existing applications have accustomed their customers to while, under the hood, automatically deploying individual Obol clusters for each individual client using a ¾ client configuration, with further customization to be launched at a later time.

Plans to opt-into additional AVSs:

-

Are you running any AVS testnets other than EigenDA?

No, would love to. -

Are there any AVSs you plan to opt-in to?

Yes, we have plans to opt-in to Espresso Systems and Omni Network. -

How do you plan to evaluate AVSs?

Evaluation Criteria & Assessment Method for AVSs:

- Team Publicity & Reliability:

- Assessment: Team profiles, past projects, social media.

- Calculation: Points for team visibility, subtract for transparency issues.

- Roadmap Clarity & Feasibility:

- Assessment: Detailed plan, realistic goals.

- Calculation: Clear goals, subtract for ambiguity.

- Ecosystem Development:

- Assessment: Partnerships, adoption, ecosystem growth.

- Calculation: Evaluate partnerships, adoption, expansion.

- Regulatory Risks:

- Assessment: Compliance, legal, strategy.

- Calculation: Compliance, regulatory response.

Total score indicates AVSs perform, with the lowest score suggesting the strongest AVS.

- Are there any types of AVSs you would not opt into?

If they don’t meet our evaluation criteria, standards and policies. This process is conducted in close collaboration with our legal department to ensure adherence to regulatory standards.

Why we chose EigenLayer: Reusing ETH to provide security across many services reduces capital costs for a staker to participate and significantly increases the trust guarantees to individual services.EigenLayer solves this problem by enabling any service, regardless of its composition (e.g. EVM-compatibility), to tap into the pooled security of Ethereum’s stakers, creating an environment for permissionless innovation and free-market governance.

The enhance visibility on social media:

- https://x.com/01node/status/1759546571950027112?s=20

- https://x.com/01node/status/1726970157770088831?s=20

- https://x.com/01node/status/1726970152003248466?s=20

- https://01node.com/01node-validator-joins-eigenlayer-as-operator-for-stage-2-of-testnet/

- https://01node.com/eigenlayer/

- https://www.linkedin.com/company/19108205/admin/feed/posts/

Operator Name: Staking.WTF

Website: https://staking.wtf/ (under construction atm)

Operator Profile: Solo-Staker collective

Team + Experience: Currently we are in a process of building our Staking.WTF team/service. Our goal is to provide bulletproof validation services by the experienced team. Staking.WTF will provide validation services, also there will be an information part of the project: metrics analysis of biggest staking and reststaking projects (with a focus on Ethereum ecosystem)

@cloudpost : CPU and GPU miner since 2014, node operator since 2019

NuCypher testnet and mainnet, Akash testnet, NEAR testnet, XX network testnet, Everscale testnet + mainnet, Mina testnet and mainnet + Genesis member (validator for Mina foundation for 6 months)

@Razoon : 10+ years in IT, CCNP Cisco engineer, Senior DevOps, TeamLead DBA (Oracle, Greenplum, Clickhouse), Hardware development enthusiast. Fairly new to crypto but actively researching crypto space

@Nold : node operator since 2020

Mina testnet and mainnet + Genesis member (consistent top240 uptime, validator for Mina foundation for 1 year), XX network testnet, Massa testnet, Iron Fish testnet

Our main goal is to build our own bulletproof server infrastructure: failover server cluster in each of the main regions Oceania/Asia/NA/EU/CIS.

We do not rent servers, our important principle is to use only self-owned hardware to have full control. Right now we run 3 clusters: 1 Selectel datacenter+ 2 private datacenter (Moscow)

Mainnet restake amount: 100+ stETH since 22th of August

Where do you run your infra: CIS/Russia (we have plans to expand to Oceania/Asia/NA/EU)

What rate do you plan to set your operator commission rate: 1-5%, depending on competition

Performance Metrics: Down for 2 updated and 2 times due to the RPC issue (which was communicated with Eigen team by Razoon in discord)

EigenDA Testnet Performance: https://goerli.eigenlayer.xyz/operator/0x8d56b0829f6e840176cfa39c21b4fccf4350be8a

Describe your experience running the EigenDA testnet. Everything runs smooth, we’re happy with all instructions and communications with the team.

How long were you in the active set? EigenDA validator since 20th of January.

Plans to opt-into additional AVSs: we plan to add more AVS, exploring options right now

Are you running any AVS testnets other than EigenDA? Currently no, but we evaluate multiple options right now

Operator Name : Stake Capital Group

Website: www.stake.capital

Operator Profile: Institutional Staker

Experience

Stake Capital group, led by blockchain and DeFi pioneers since 2011, focuses on investing in, supporting, and building next-generation blockchain projects. We began mining in 2011, investing in 2013, and building in 2015, enabling us to provide high-quality and trustworthy services to our clients and partners.

We have been serving as validators on approximately fifteen blockchains for several years. Our global presence, with a team based in Europe and members spread across the world, underscores our international expertise and commitment to advancing blockchain technology. As an active early-stage venture capitalist, we offer an incubation and acceleration program and engage in quantitative strategies such as validation, liquid staking, market making, and liquidation.

Our team is dedicated to delivering exceptional node and validation services, ensuring the projects we choose to run nodes for operate smoothly and efficiently, further emphasizing our holistic approach to the blockchain ecosystem.

Team

One DevOps engineer with ten years of experience split between web2 and web3. His blockchain experience has primarily been on launching, maintaining, and operating validators, bridges, and oracles, as well as building out liquid staking infrastructure.

One quant researcher with ten years of experience split between traditional finance and crypto

One smart contract engineer with 5 years of direct experience.

The team is split between the EU and USA. The team is supported by a Business Developer, and a CEO + CIO both with quite technical backgrounds (cybersecurity/distributed systems/OG blockchain and DeFi; quantitative finance/algorithmic).

Mainnet restake amount: 0

Where do you run your infra?

Our infrastructure is strategically distributed worldwide, in the USA (Virginia and Ohio) and Germany (Frankfurt) and can also accommodate 30 other regions if required to maintain optimal performance and reliability.

What rate do you plan to set your operator commission rate at: Competitive market rate (5%)

Performance Metrics: ~99.98% success rate across all validators, no slashing in our experience.

EigenDA Testnet Performance: Describe your experience running the EigenDA testnet.

- 5 months (November 2023 - March 2024)

- For our participation in the Eigenlayer testnet since November 2023, we have been able to gather 34,404,951.9157 restaking points.

Plans to opt-into additional AVSs: No additional AVS, only EigenDA

Are there any AVSs you plan to opt-in to? Yes

How do you plan to evaluate AVSs? Depending on purpose and hardware demand.

Are there any types of AVSs you would not opt into? N/A

Operator Name: EffenbergGesture

Website: N/A

Operator Profile: Solo-Staker

Experience:

- Solana Mainnet Validator: https://solana.org/sfdp-validators/A6ZmvWcKGVUnwpum4GhVn7CftUJgVFNSg6biedaNKHBC

- Mina Protocol Genesis Validator: https://minaexplorer.com/wallet/B62qr6owPPGkPVLVFcXnQHvijQxH4TAVqXhJAcMuKWvLXnHCtLZyxPZ

- ex-REN Mainnet Validator

- Operated nodes in a variety of testnets: Stacks, Evmos, Aleo, IronFish, Hopr, Masa, Aptos, Namada.

Team: Solo-Validator

Mainnet restake amount: 5 ETH

Where do you run your infra: Germany, USA

What rate do you plan to set your operator commission rate: TBA (lower than average)

Performance Metrics: https://stakewiz.com/validator/8EwqVDPwa773DXfymS5dhvahabfjTSB3qxnpq9kR7bNp

EigenDA Testnet Performance:

- Describe your experience running the EigenDA testnet. Smooth

- How long were you in the active set? Since December 6, 2023: https://goerli.etherscan.io/address/0xef502107f6528d30b1b6de57a4d10a87c780e261

- What were your performance metrics? Close to 100% uptime since entering the active set excluding seconds-length breaks during necessary updates

Plans to opt-into additional AVSs:

- Are you running any AVS testnets other than EigenDA? Currently, No

- Are there any AVSs you plan to opt-in to? Omni Network, AltLayer, Lagrange

- How do you plan to evaluate AVSs? By the idea behind and the level of community and institutional support

- Operator Name: Overground

- Website: https://node.overground.one

- Operator Profile: Solo-Staker.

- Experience: we have 3+ years experience in staking and operating nodes on several networks

- Team: we are a group of Early crypto adopters and highly skilled and actively operating nodes

- Where do you run your infra: Finland, Germany, USA

- What rate do you plan to set your operator commission rate: 5 %

- Performance Metrics: We have 99.8% uptime on goerli EigenDA testnet

- EigenDA Testnet Performance:

- since we were in active set from Dec-15 we experienced several upgrades and all ones are smooth and takes under than 2 hours to fully updated.

- How long were you in the active set? from Dec-15 2023

https://goerli.eigenlayer.xyz/operator/0x414a163f24463a98bddc0a04a18fe790ad546f76 - What were your performance metrics? 99.98 uptime

- Plans to opt-into additional AVSs:

- Are you running any AVS testnets other than EigenDA? not yet but our team is ready for upcoming AVSs.

- Are there any AVSs you plan to opt-in to? yes we are waiting for their projects to integrated with eigenlayer and than we started opting in.

- How do you plan to evaluate AVSs? with our high performance we could provide huge rewards for our delegators.

- Are there any types of AVSs you would not opt into? there isn’t currently

-

Operator Name LayerZero Intern

-

Website My Twitter is my website: https://twitter.com/layerzerointern

-

Operator Profile Solo

-

Experience: Years of fkn around and finding out

-

Team: Team is just me. I text Primo sometimes but im not on LZ team

-

Mainnet restake amount: Chill the feds can see this

-

Where do you run your infra: Frankfurt

-

What rate do you plan to set your operator commission rate: idk yet. whatever the boys r feeling tbh maybe smn like 5% about right?

-

Performance Metrics: I’m nice w it. Crazy uptime on Goerli till that chain flopped lol

-

EigenDA Testnet Performance:

I enjoyed my time in the EigenDA testnet. I was in the active set for over a month, upgraded the node a few times in a timely fashion. Idk nothing about performance metrics tbh my node seemed chill tho. -

Plans to opt-into additional AVSs:

- Are you running any AVS testnets other than EigenDA?

Nah not atm looking for something dope. - Are there any AVSs you plan to opt-in to?

Nah not yet - How do you plan to evaluate AVSs?

I just peep if they nice or not. Lowkey got an idea for one i might have to cook - Are there any types of AVSs you would not opt into?

The nice ones

- Are you running any AVS testnets other than EigenDA?

Operator Name: Kaizen

Operator Profile: Solo-Staker

Experience: Since last year, We’ve been actively involved in running testnet and mainnet nodes. We operated Sui and Aleo validator nodes before participating in EigenDA testnet.

Team: We are a team of six members with programming skills. Everyone possesses the essential skills to explore any issue and effectively operate nodes.

Mainnet restake amount: 8

Where do you run your infra: US and DE

What rate do you plan to set your operator commission rate: 5%

Performance Metrics: Almost 100% uptime

EigenDA Testnet Performance:

Describe your experience running the EigenDA testnet: During our time on the testnet, we’ve gotten better at using the EigenDA network, solving problems, and improving our performance. Our experience has helped us refine our strategies, fix issues, and contribute to testing EigenDA

How long were you in the active set? Nearly 1 month

What were your performance metrics? 99% uptime minus the time required to apply updates

https://goerli.eigenlayer.xyz/operator/0x88363E1F47315A57FA81576c8D50Bd49f273D4a4

Plans to opt-into additional AVSs:

Are you running any AVS testnets other than EigenDA? No

Are there any AVSs you plan to opt-in to? No, We have no plan at this moment.

How do you plan to evaluate AVSs? Based on new technologies and their impact to blockchain and also how they involve the community