This topic came to my attention while working on my content about the EIGEN token. While reading Eda’s thoughtful writing about EIGEN, I encountered Vitalik’s post “Don’t Overload Ethereum’s Consensus.” I made a mental note to explore this further, and now feels like the right time to dive in.

Actually, I want to discuss this topic with anyone who’d like to share their thoughts. You can think of this piece of writing as a kind of ‘thinking out loud’ session.

In this writing, I’ll simply try to talk about Vitalik’s concerns and thoughts on overloading Ethereum’s consensus and use insights from the EigenLayer and EIGEN whitepapers to consider whether EigenLayer respects Ethereum’s foundational limits or risks crossing them.

Let me first explain what I mean by Overloading Ethereum’s Consensus.

Ethereum’s consensus mechanism is the backbone of its decentralized security, providing trust and reliability for all participants. When I talk about “overloading Ethereum’s consensus,” I mean situations where external applications, protocols, or mechanisms demand more from Ethereum’s social or technical consensus than it is designed to handle.

Vitalik’s Thoughts on Overloading Consensus

In Vitalik’s post, he emphasizes:

“Dual-use of validator staked ETH, while it has some risks, is fundamentally fine, but attempting to ‘recruit’ Ethereum social consensus for your application’s own purposes is not.”

This is the central concern. Vitalik is not against innovation but warns about projects that expand Ethereum’s social consensus beyond verifying its protocol rules. Such expansions could make Ethereum vulnerable to disputes, governance fatigue, and even community splits. His argument focuses on protecting Ethereum’s neutrality and ensuring it remains resilient.

Examples: Re-Using Validators vs. Overloading Consensus

Re-Using validators doesn’t always result in overloading consensus. To illustrate the difference, Vitalik provides examples of low-risk validator reuse versus high-risk consensus overreach. Let’s take a look at them:

Low Risk Example:

This scenario allows Ethereum validators to participate in additional systems without overburdening Ethereum’s governance or creating expectations for its intervention:

Dogecoin’s Dual-Staking Model:

- How It Works: Let’s say, Ethereum validators can participate in Dogecoin’s proof-of-stake system by redirecting their staking withdrawal address to a contract that enforces Dogecoin’s rules. TL&DR: Ethereum validators start also being part of Dogecoin as validators by using their ETH

- Consequences for Misbehavior: If a validator violates Dogecoin’s rules, they are slashed (losing some of their ETH), and the funds are used to burn DOGE.

- Why It’s Low-Risk:

- Misbehavior impacts only the validator involved; Ethereum’s broader social consensus is not expected to resolve issues.

- The system is self-contained, and no external governance decisions are imposed on Ethereum.

High Risk Example:

This scenario involves mechanisms that implicitly or explicitly expect Ethereum’s social consensus to resolve disputes or enforce penalties, creating systemic risks:

eCash’s Dual-Staking Model:

- How It Works: Let’s say, Ethereum validators also can dual-stake in eCash. However, if a majority of validators collude to censor eCash transactions, eCash developers expect Ethereum to fork the chain to punish malicious validators.

- Why It’s High-Risk:

- This assumes Ethereum’s community will intervene in external disputes, putting undue pressure on its governance.

- Such assumptions could lead to contentious debates and potential community splits.

These examples highlight Vitalik’s key concern: solutions that tie Ethereum’s governance to external disputes stretch Ethereum’s consensus too far.

Let me explain the EigenLayer’s moves about this important topic.

EigenLayer’s Perspective

At first glance, EigenLayer’s restaking model might seem similar to the high-risk examples Vitalik warns against. It allows Ethereum validators to reuse their staked ETH to secure additional protocols, raising the question: does EigenLayer risk overloading Ethereum’s consensus?

The answer lies in EigenLayer’s thoughtful design, which leverages the EIGEN token as a universal intersubjective work token to mitigate risks and keep Ethereum’s consensus intact. What does even intersubjective mean?

Let’s rewind the tape a bit and revisit some foundational concepts to set the stage.

To understand how EigenLayer mitigates risks, it’s helpful to briefly categorize faults in digital systems. Digital services encounter various types of faults, which can be grouped as follows:

Faults in Digital Services

- Objectively Attributable Faults: Clearly identifiable using cryptographic methods, such as double-signing a block, which can be proven on-chain.

- Intersubjectively Attributable Faults: Require external agreement outside the chain, like resolving oracle price discrepancies, where human judgment plays a role.

- Non-Attributable Faults: Cannot be externally verified, such as distinguishing between a malicious system and participant in secret-sharing setups.

While objectively attributable faults can be resolved on-chain using ETH staking and cryptographic mechanisms, intersubjectively attributable faults present unique challenges. These faults require external agreement among observers, such as reconciling oracle price discrepancies. Unlike ETH, which secures tasks with objectively attributable faults, the EIGEN token is specifically designed for tasks that rely on intersubjective assessments.TL&DR: EigenLayer focuses on intersubjectively atrributable faults.

First of all, we can take a look at the current mechanisms for resolving intersubjectively attributable faults:

Current Mechanisms for Resolving Intersubjectively Attributable Faults

Majority Voting and Committee mechanisms might suffer from the ‘Tyranny of the Majority’ problem. When I encountered the third mechanism, a light bulb went off in my mind. The ‘slashing-by-forking’ mechanism addresses disputes by forking the chain and slashing the stake of faulty operators. However, this approach is both technically and socially expensive. This brings to mind Vitalik Buterin’s concept of the ‘Dual-use of validator staked ETH’: leveraging the same staked ETH for multiple purposes to enhance security while minimizing economic costs.

However, here’s the challenge: If EigenLayer aims to address intersubjectively attributable faults and resolve them through slashing, relying on chain forking every time a malicious operator acts poorly raises a significant concern. This aligns with Vitalik’s warning about overloading Ethereum’s social consensus.

SO,

How do we extend the cryptoeconomic benefits of slashing-by-forking through social consensus to address any intersubjectively attributable faults?

This is where the token forking mechanism comes into play, offering a more scalable and efficient solution. Instead of burdening Ethereum’s social layer with every dispute, token forking enables the resolution of intersubjectively attributable faults in a decentralized manner. By creating parallel token realities, it allows stakeholders to align their preferences without necessitating a hard fork of the chain itself.

There’s an additional problem we’ll need to consider, but first, let me highlight the beauty of the token forking mechanism.

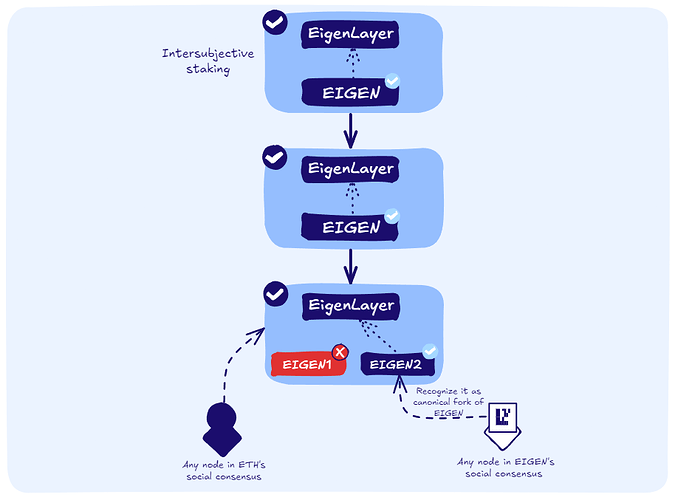

There’s a good diagram in the EIGEN token’s whitepaper; let me redraw it and explain it step by step.

Step 1

Step 1: Chain-Forking

Here’s how our daily life on Ethereum unfolds while forking the chain to counter a malicious majority. Ethereum’s social consensus filters for the canonical fork in pursuit of chain validity.

Step 2

Step 2: Restaking, if not designed properly, can overload Ethereum’s social consensus

Now, it’s time to demonstrate what happens if the restaking mechanism isn’t designed properly. As you can see, it can overload Ethereum’s social consensus because the chain would need to be forked for every malicious behavior.

Step 3

Step 3: Token-Forking

This is where the token-forking mechanism comes into play. EigenLayer prevents overloading Ethereum’s social consensus by shifting from chain-forking to token-forking. Ethereum nodes don’t need to be aware of what’s happening in EigenLayer or prepare to fork the chain.

Actually, when I read about this token forking mechanism, I just started thinking about millions of forks of the tokens. Of course, I’m not the only one who thought about this problem… *The problem is that if the token forking mechanism is solely backed by EIGEN, how can DeFi markets or even centralized exchanges track all of these forks?*EIGEN token should be ISOLATED. How?

Two-Token Model

EigenLayer leverages a dual-token mechanism to efficiently manage its network’s diverse needs. This model separates staking and non-staking use cases, ensuring robustness in cryptoeconomic security while supporting a wide range of applications.

Two Token Model for Isolation

1. bEIGEN (Backing EIGEN):

The bEIGEN token stands for staking activites as backing token. Users lock up their ETH as bEIGEN, which directly secures the network’s actively validated services (AVS).

Key Characteristics:

- Staking and Security: bEIGEN is involved in securing the network and is subject to slashing when faults are detected.

- Forking Mechanism: In cases of intersubjectively verifiable faults, bEIGEN can be forked to address disputes or maintain network integrity.

2. EIGEN:

The EIGEN token is the universal intersubjective work token, designed for non-staking activities like DeFi.

Key Characteristics:

- Isolation from Network Security Risks: EIGEN is unaffected by forking events in bEIGEN, preserving its utility for non-staking applications.

- DeFi and Beyond: EIGEN enables seamless participation in decentralized finance and supports products built on EigenLayer without security-related complexities.

Together, these two tokens form a complementary system where bEIGEN focuses on maintaining network security, and EIGEN drives the adoption and utility of EigenLayer’s broader ecosystem. This division of responsibilities minimizes systemic risks while maximizing EigenLayer’s potential to support innovation.

Conclusion

In conclusion, the concern about overloading Ethereum’s consensus is crucial as projects like EigenLayer push the boundaries of what’s possible on the network. While EigenLayer’s restaking model might seem to challenge Vitalik’s warnings, its design, particularly the two-token model, ensures that Ethereum’s core consensus remains intact.

By separating staking and non-staking activities, EigenLayer allows for innovation without overburdening Ethereum’s governance. This balance between security and flexibility is key to scaling decentralized applications without compromising Ethereum’s foundational principles.

It’s a promising approach, but as with all innovations, its true impact will unfold over time.

Thank you for reading! That’s all for now on this topic. I didn’t expect to dive so deep, but it’s an important issue worth exploring. Appreciate your time!

You can also read it from Mirror: https://mirror.xyz/merttcanc.eth/fw6KA--3SDUzgJPAIO44BgwC4v31RK-6rc4dE8sSwaE