Hey, here I am again with another ‘inner voice’ content!

I created this post by taking referance from @bmpalatiello blog post: here

So, let’s start!

𝐅𝐨𝐥𝐥𝐨𝐰 𝐭𝐡𝐞 ‘𝐈𝐧𝐧𝐞𝐫 𝐕𝐨𝐢𝐜𝐞’ 𝐀𝐫𝐫𝐨𝐰𝐬, 𝐓𝐡𝐚𝐧𝐤 𝐌𝐞 𝐋𝐚𝐭𝐞𝐫

Remember when we simplified how Operators allocate Unique Stake in the previous post about EigenLayer’s new security model(https://x.com/merttcanc/status/1835373873631477802…)?

Now, we’ll unpack the nuanced mechanics of allocating and slashing Unique Stake in EigenLayer!

So, let’s dive into the world of Mechanics of Unique Stake in Eigenlayer’s Security Model!

1/12 ![]()

First, let’s start with a new term Magnitude that we’ll be using for unique stake allocation.

After that, we’ll alocate them!

It’s time to allocate! Place your chess pieces carefully! But, there might be some delays (:

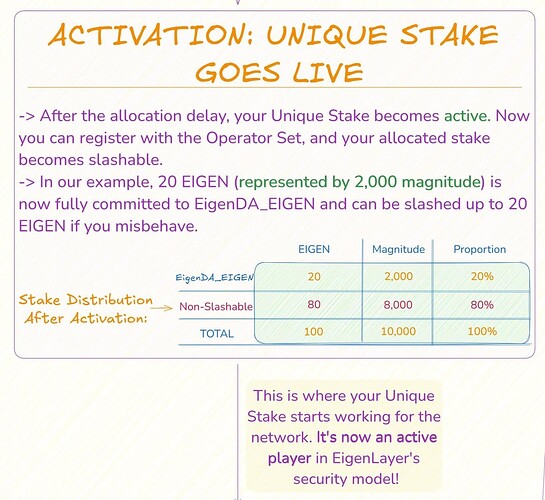

Are you ready to be an active player in EigenLayer’s security model? Let’s activate!

An important note for the next part

Balance your Unique Stake!

Let’s diversificate!

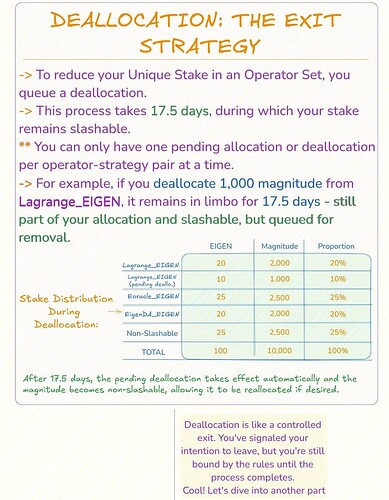

We allocated, but, what happens when an operator needs an exit strategy?

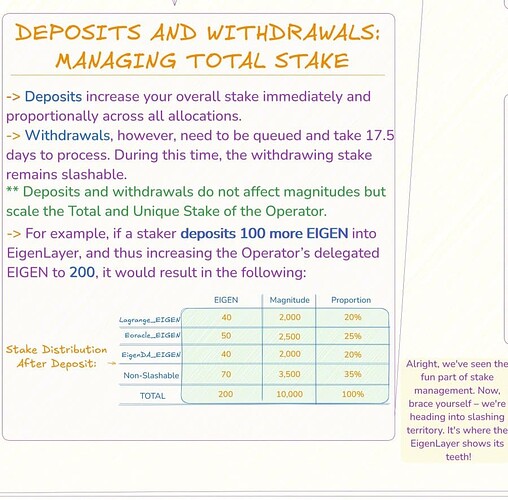

In addition to allocation and deallocation, we’ve also stakers in EigenLayer ecosystem that deposits and withdraws their funds. What happens, then?

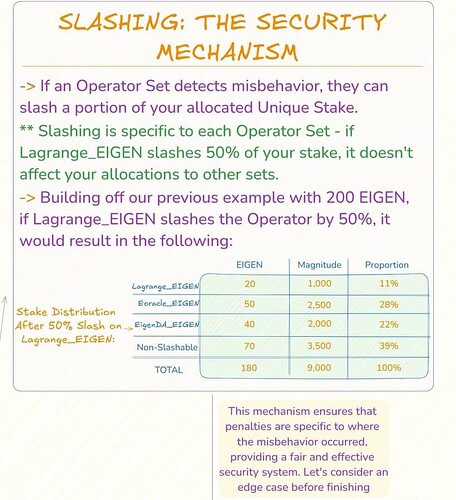

It’s time to talk some serious things now :)

SLASHING IS HERE!

Before we finish the inner voices, shall we think about an edge case?

Well well well, let’s finish it with conclusion before I make you bored

Thank you so much for reading! Again again again, FEEDBACKS ARE APPRECIATED

MY DM IS ALWAYS OPEN🍃